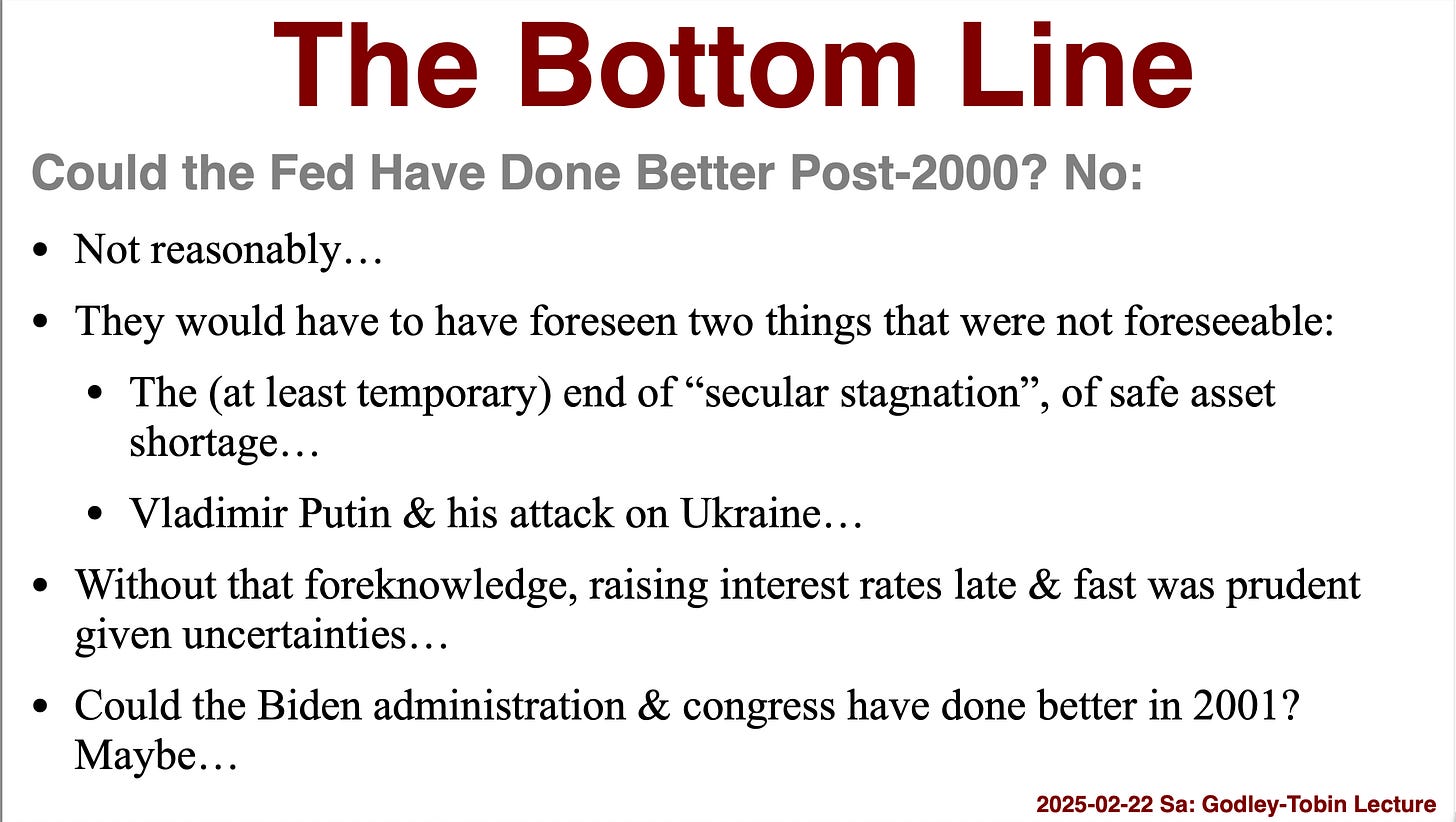

My Godley-Tobin Lecture at the Eastern Economic Association turned out to be a full-throated defense of Federal Reserve monetary policy in the 2020s: moving late & moving fast has been remarkably successful ex post, and was certainly much more than defensible as a strategy ex ante. We are very lucky to have had Jay Powell, his committee, and his staff in the hot seats so far this decade. You can unreasonably claim that they ought to have done better. In my view, you cannot reasonably claim so…

I still do not have an edited transcript. But there is a video, courtesy of Mathias Vernengo:

<https://mediaspace.bucknell.edu/media/8th+Godley-Tobin+Lecture+by+J.+Bradford+DeLong/1_m5aw7tyj>

===

===

Plus slides:

-

There is something special & “macroeconomic” that demands public-sector attention—especially in times of general gluts and financial panic, contra Say’s Law.

-

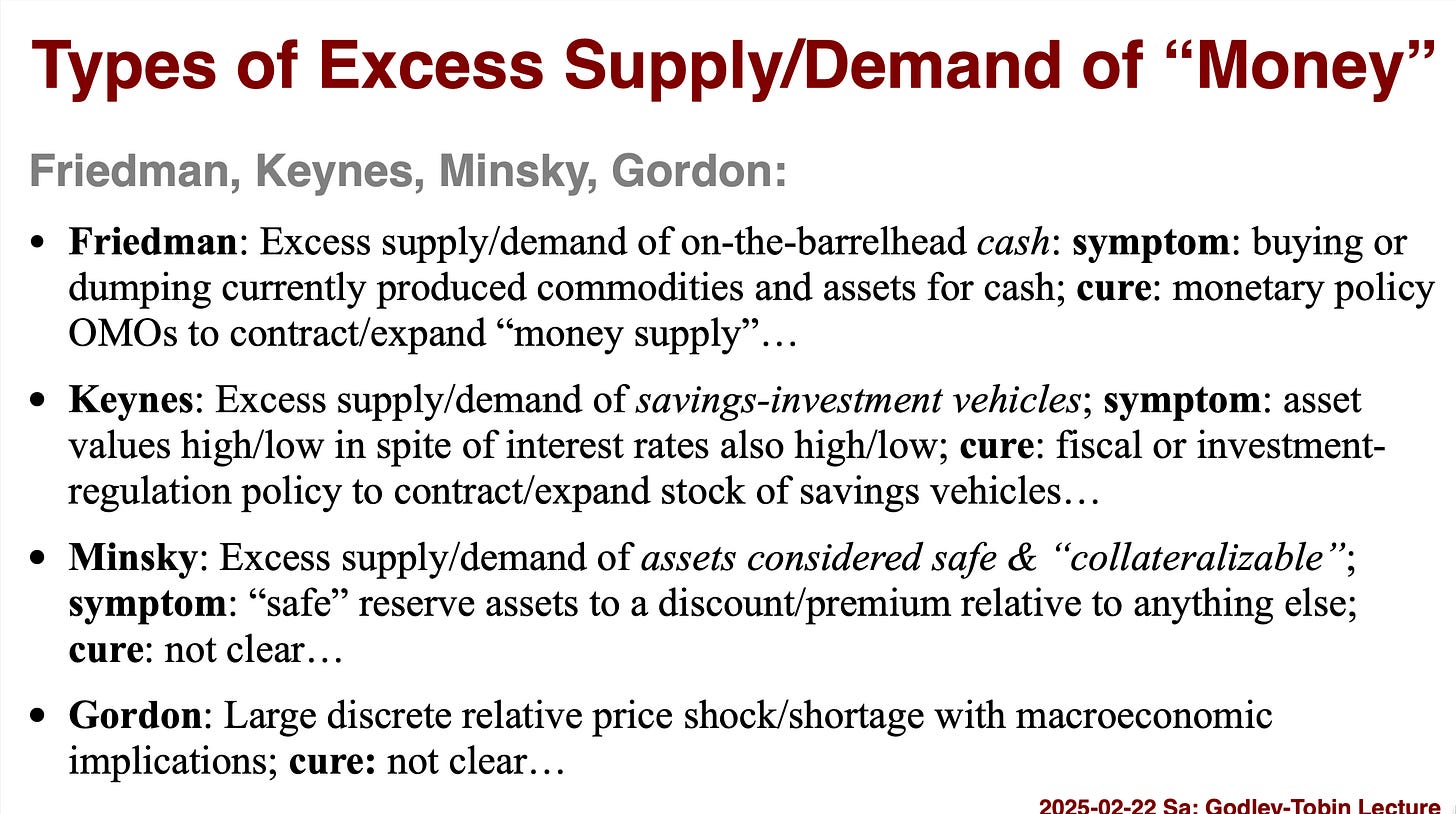

Macroeconomic dysfunction arises from excess demand for “money”, broadly defined—not just cash, but safe assets, savings vehicles, or collateral.

-

Keynes’s insight: macroeconomic instability undermines capitalism, which presumes a stable value-measuring rod. Without it, the system risks collapse.

-

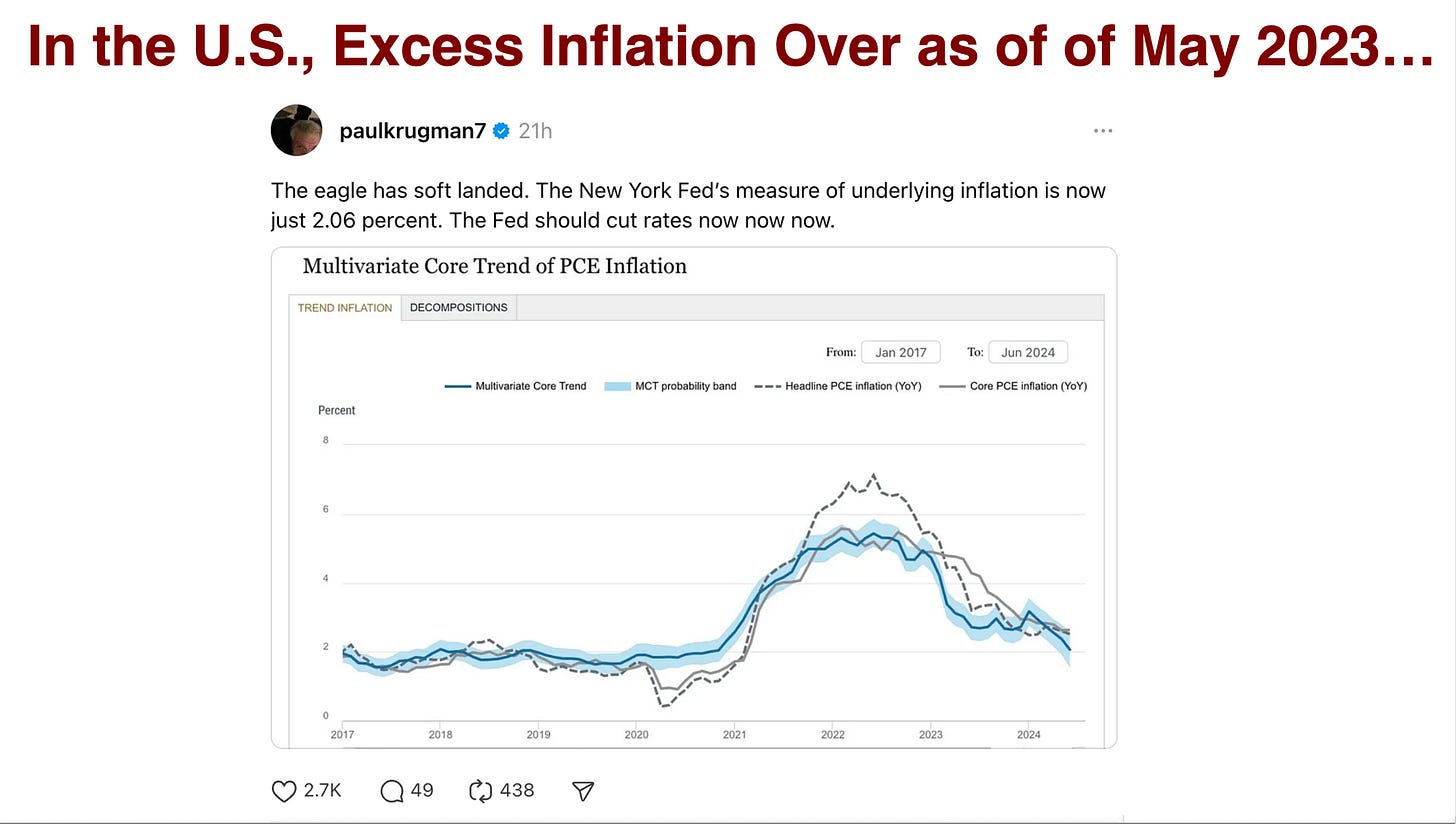

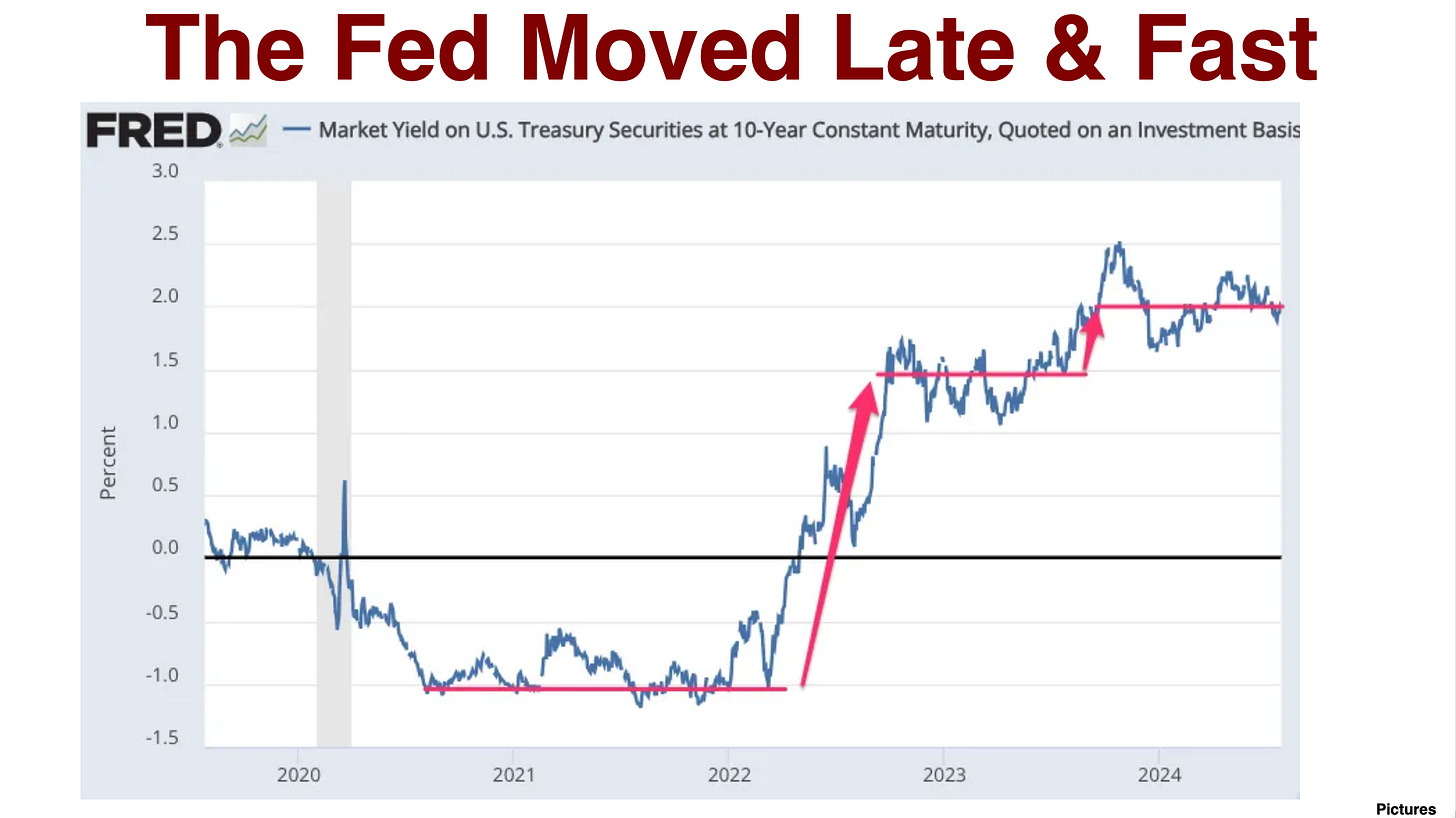

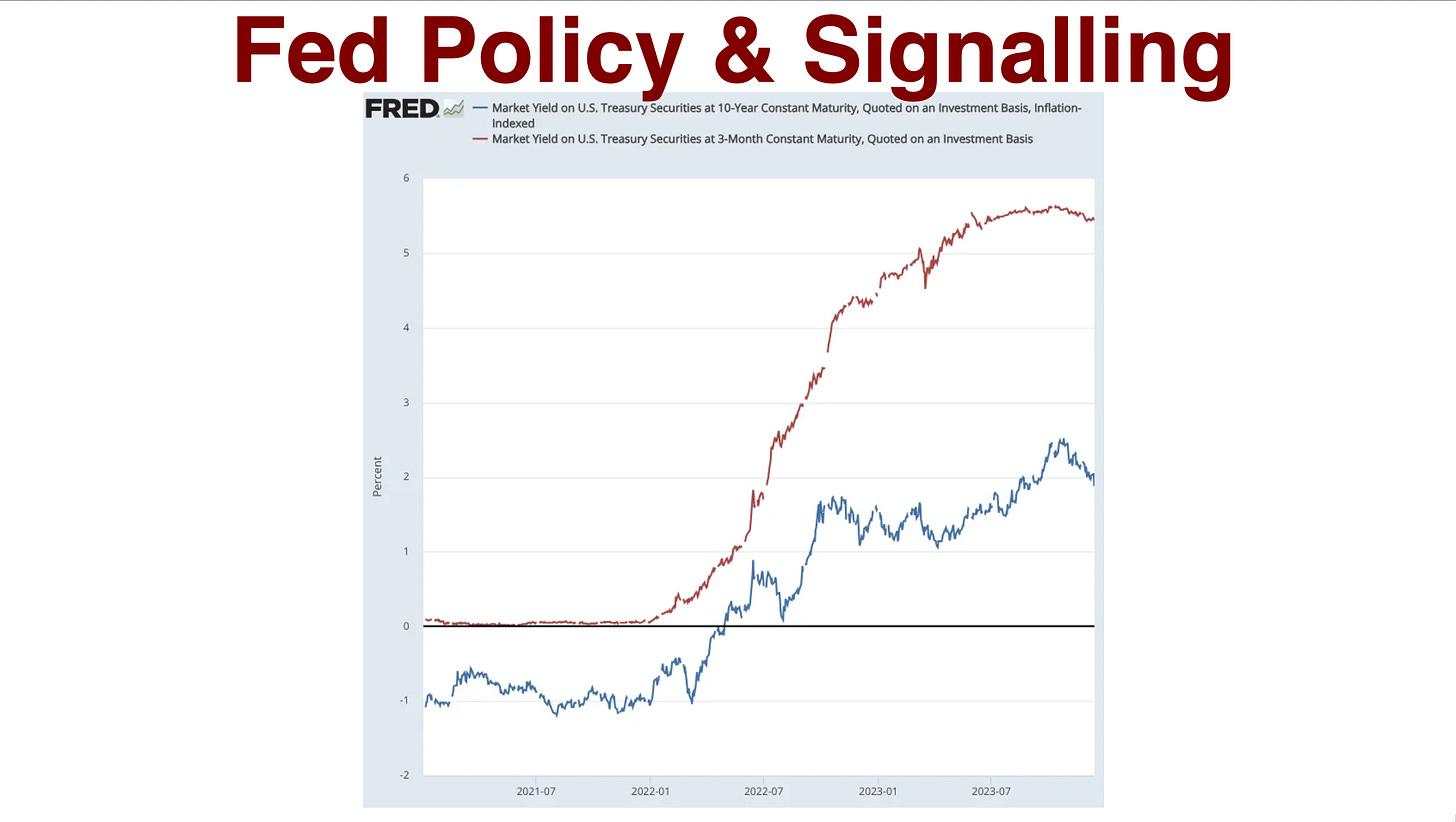

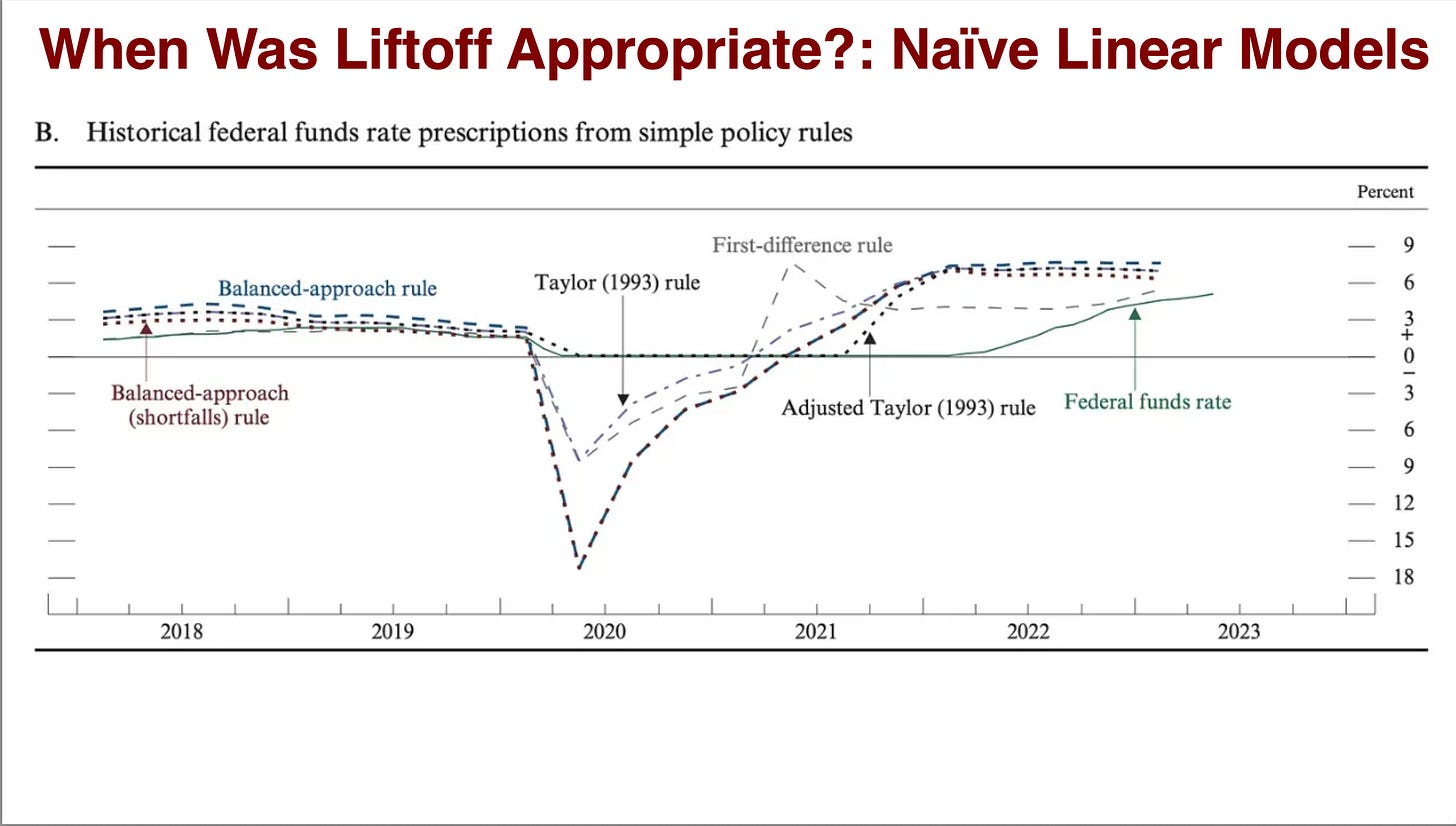

The Fed acted prudently, not perfectly, post COVID. It moved “late and fast,” which was reasonable given 2021’s uncertainties.

-

The Biden administration’s 2021 fiscal expansion (the American Rescue Plan) was in all likelihood justifiable ex ante, even if it contributed to inflation ex post.

-

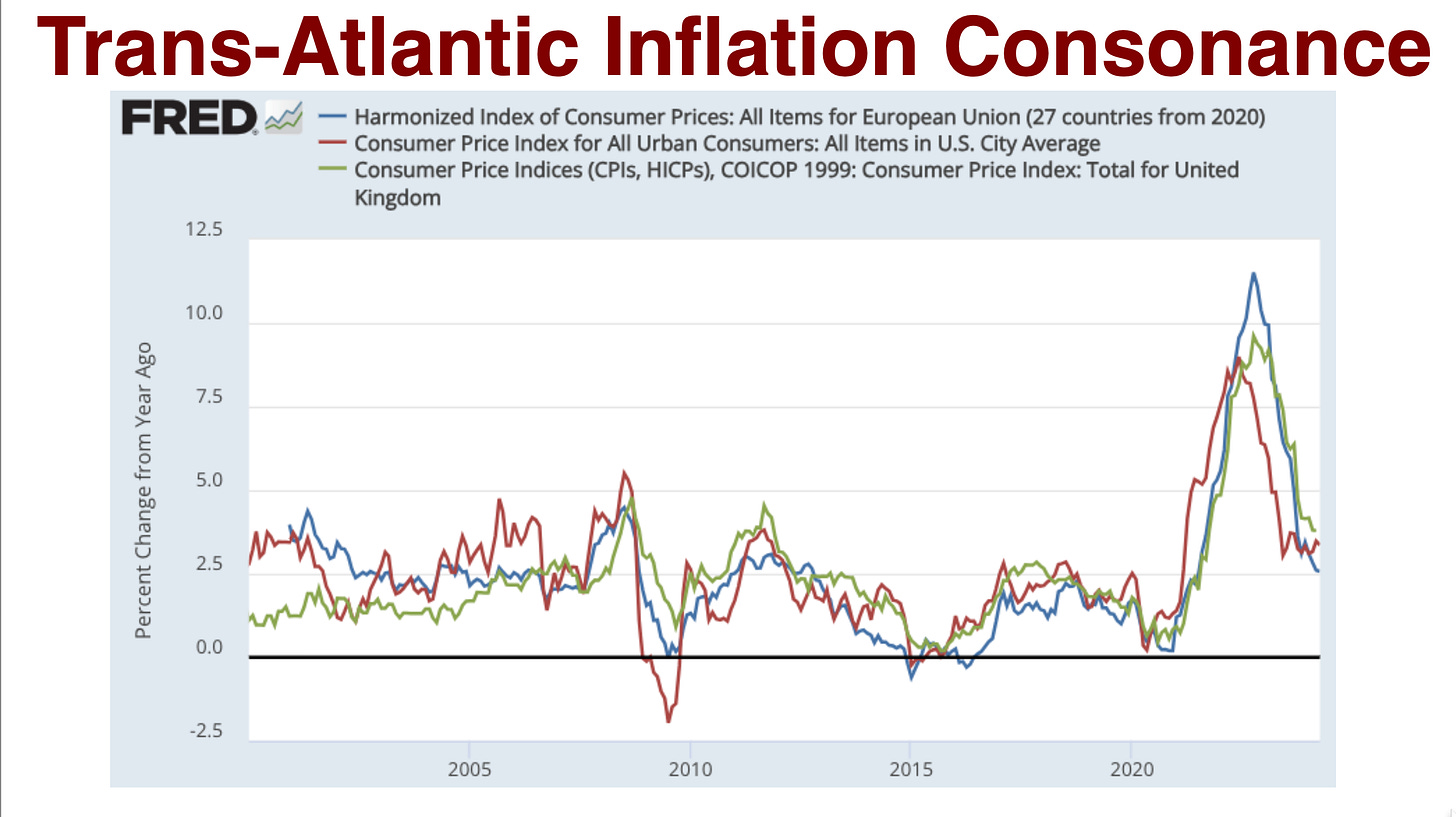

Inflation post-COVID was transitory—but longer and stronger than most expected, due to reopening, supply chain shocks, and the Putin shock.

-

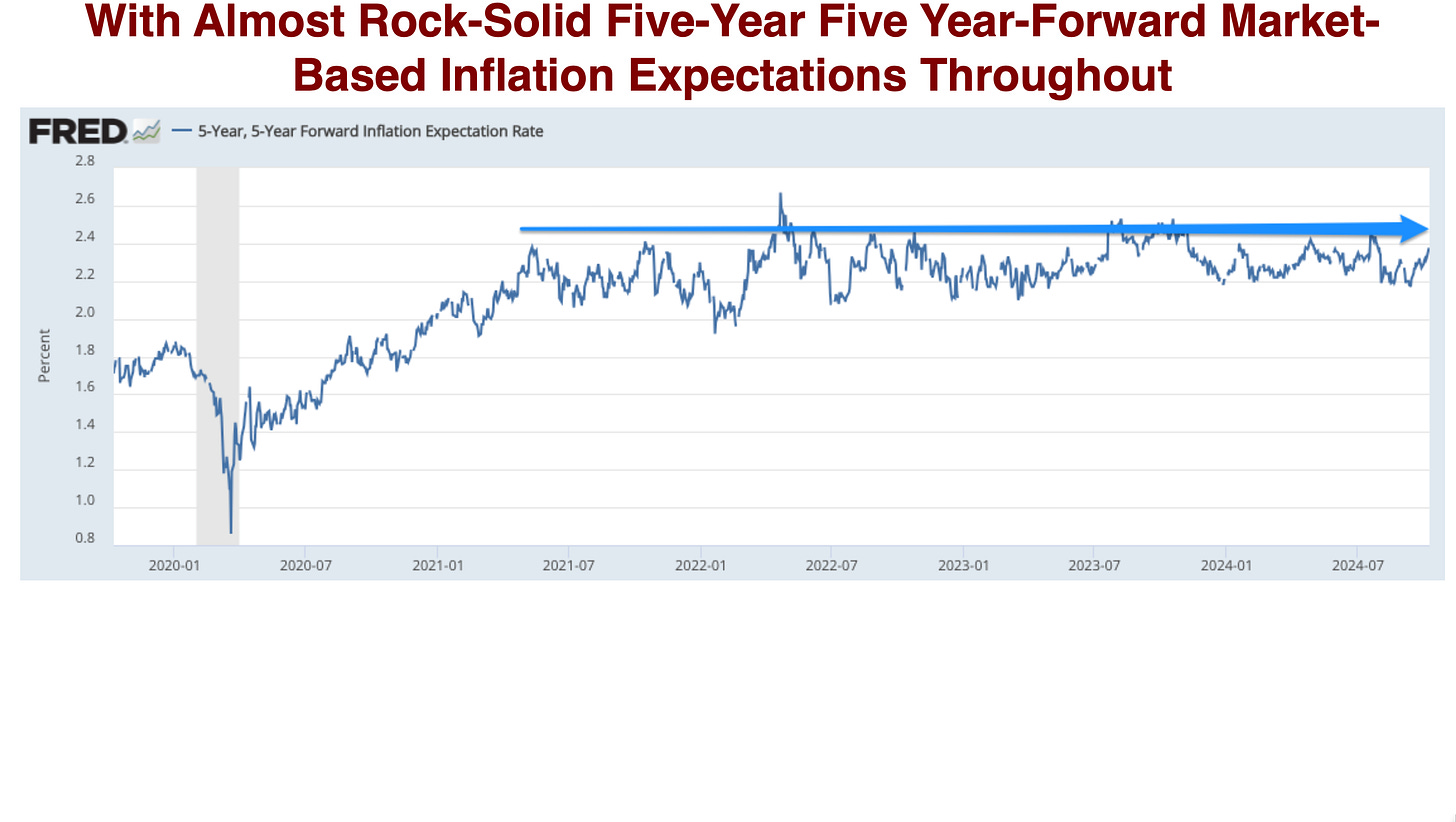

Expectations remained well-anchored, unlike in the 1970s. This meant inflation didn’t become self-reinforcing.

-

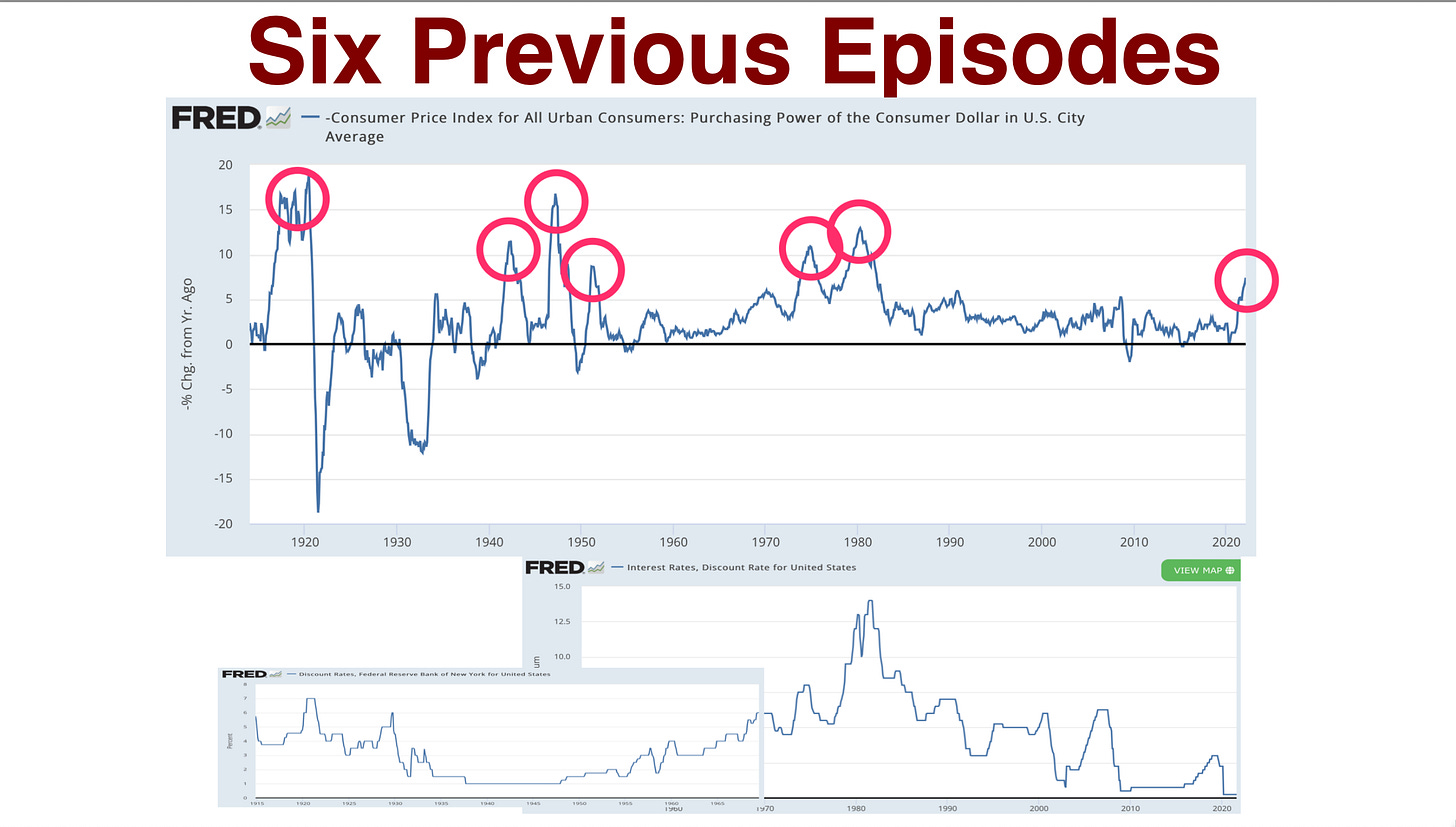

Only the 1970s truly fit the “adaptive expectations” inflation spiral model. Most other inflation episodes ended “naturally.”

-

Monetary policy alone isn’t enough at the zero lower bound; fiscal policy is essential—but often politically unavailable.

-

Obama’s 2010 austerity speech reflects how even center-left governments can shy away from necessary fiscal expansion.

-

We must reckon with structural inflation needs—there may be a natural rate of inflation that greases economic transitions.

-

The economy of the 2020s is not the economy of the 1990s or 1970s. Macroeconomic structure evolves each generation.

-

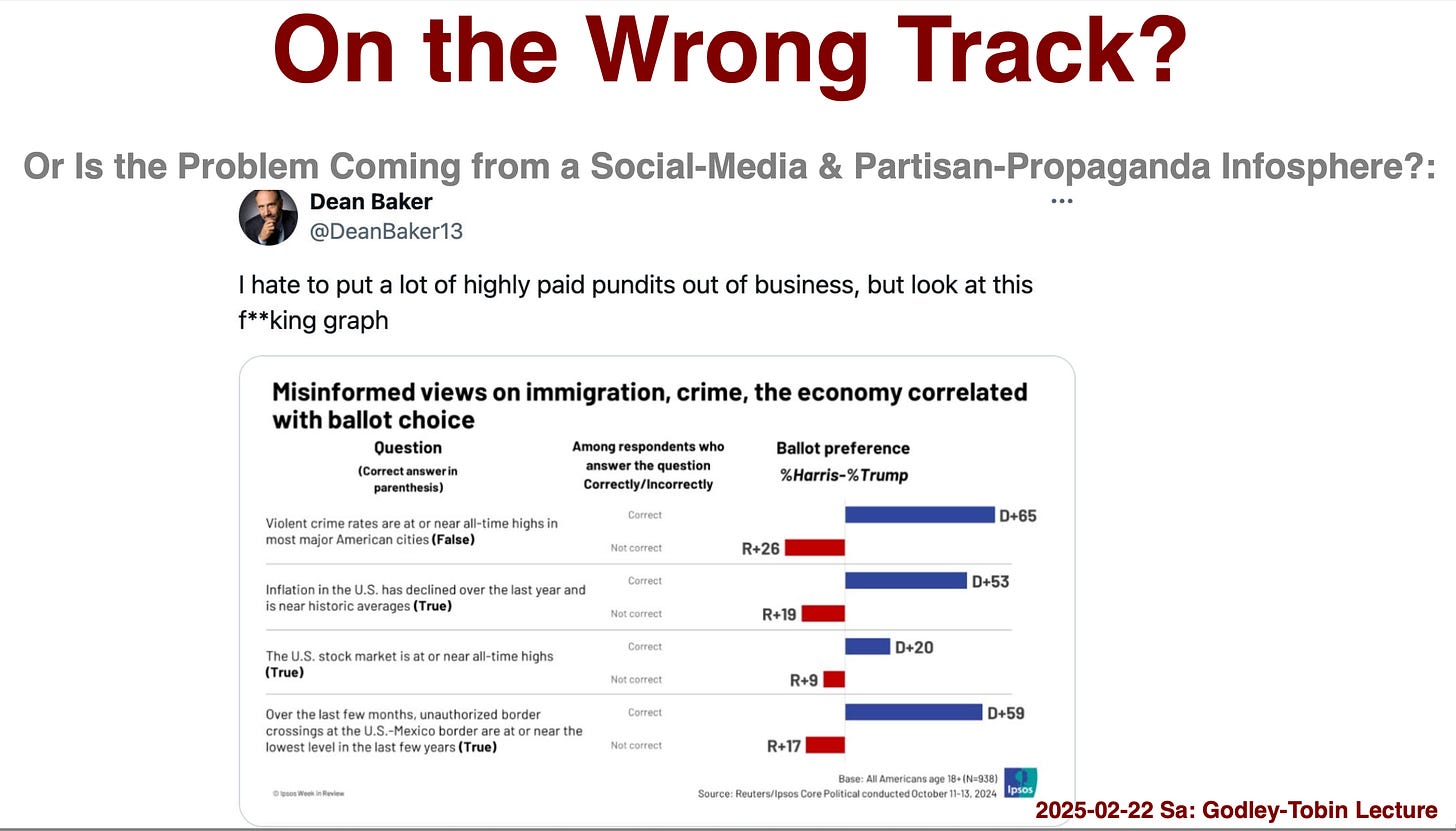

Larry Summers was right: the post-COVID inflation became a problem, but not the economic problem he had forseen; rather it became a purely political problem.

-

Public discontent may stem more from malignant & mendacious political infospheres than from direct personal hardship—many feared for others’ financial situation, not their own.

-

We should give Jay Powell & the Fed staff enthusiastic high fives for successfully managing through a nearly impossible moment.

-

The really old debates—from Say and Malthus to Keynes—remain profoundly relevant, as we struggle to stabilize an economy in constant transformation.