I was trying to think about how to contextualize the impact of the Trump 10%/60% tariffs on inflation. McKibbin-Hogan-Noland (2024) trace out the impact of this measure (as well as mass deportation) on inflation using an updated version of the G-Cubed model. In 2025, they estimate inflation will be 0.6 percentage points above baseline. Goldman-Sachs also come up with similar implied effects (although in their scenario, they only assume a portion of the tariffs are implemented)

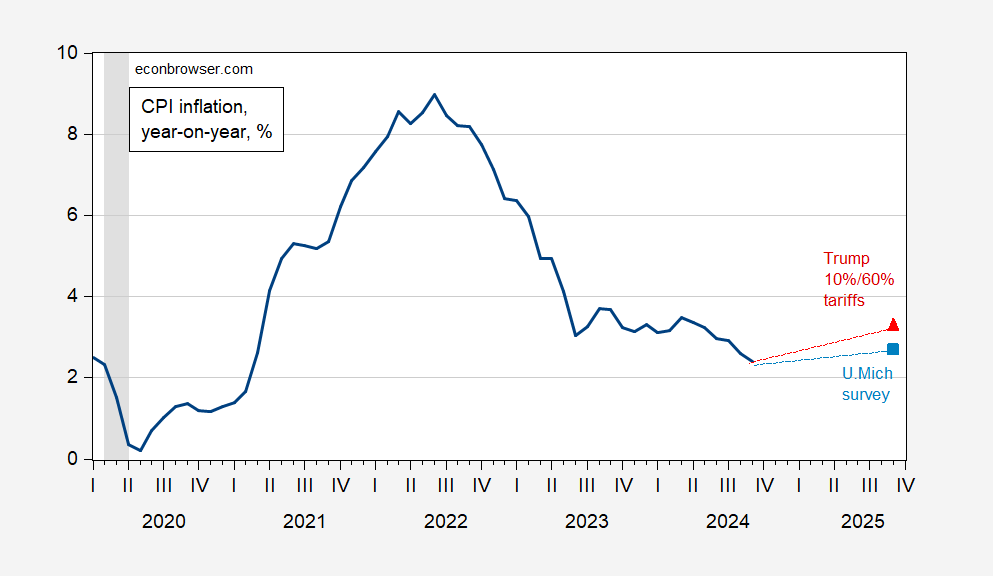

If I add the 0.6 ppts to September 2025 expected inflation (according to the U.Michigan survey), then, I obtain the following picture.

Figure 1: Year-on-Year CPI inflation (bold blue), UMich survey of consumer expectations (light blue square), UMich expectations plus 0.6 ppts (red triangle). Source: BLS via FRED, UMichigan, McKibbin-Hogan-Noland (2024), and author’s calculations.

Note that mass deportation of only (!) 1.3 mn net immigrants would lead to about 0.35 ppts higher inflation in 2025, 0.55 ppts by 2026. (The deportation on net of 8.3 million would lead to about 2.25 ppts higher inflation by 2025, and 3.5 ppts by 2026.)

My discussion of tariffs and cost of living on WPR the other day. More discussion at Main Street Agenda: Inflation in Milwaukee on October 15 (with my colleague J. Michael Collins and other panelists).