Industrial and manufacturing production out today, retail sales out yesterday. All three are up, with IP +0.7% m/m and mfg +0.9% (vs. 0.2% and 0.3% Bloomberg consensus, respectively) but retail sales remain noticeably down from prior peak.

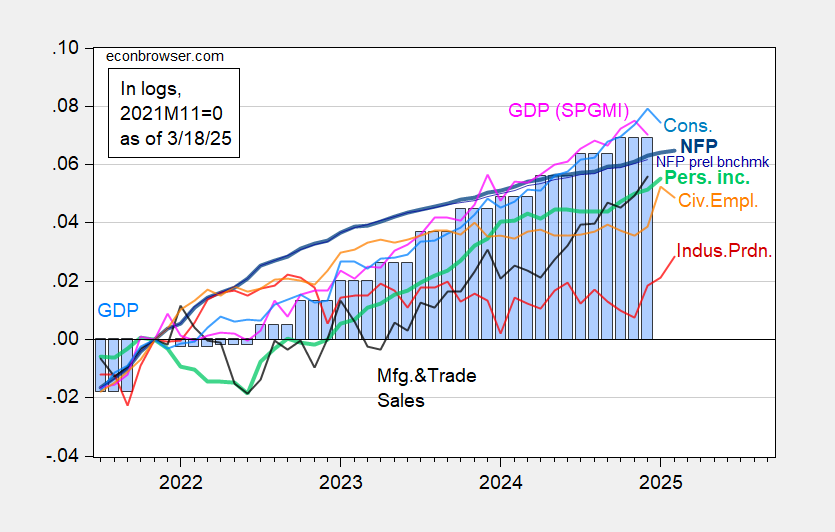

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), implied NFP from preliminary benchmark through December (thin blue), civilian employment as reported (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q4 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (3/3/2025 release), and author’s calculations.

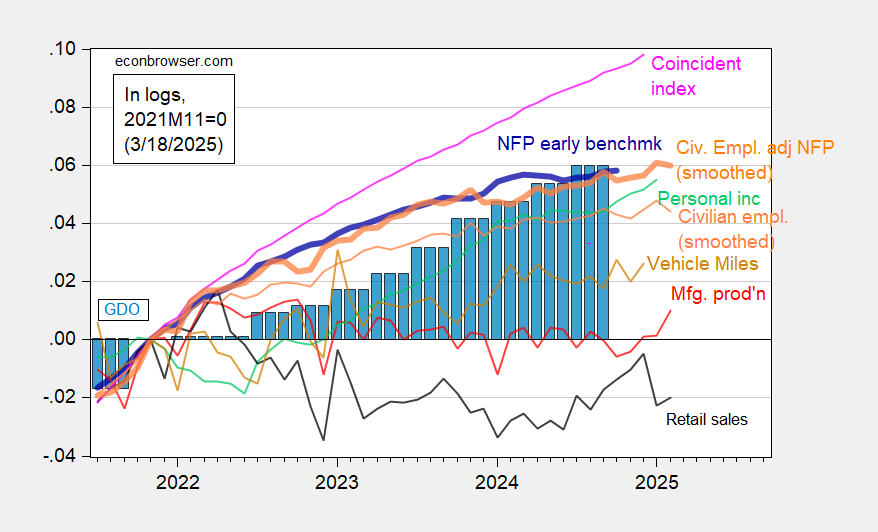

Figure 2: Implied Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted smoothed population controls (bold orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), real retail sales (black), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve via FRED, BEA 2024Q4 2nd release, and author’s calculations.

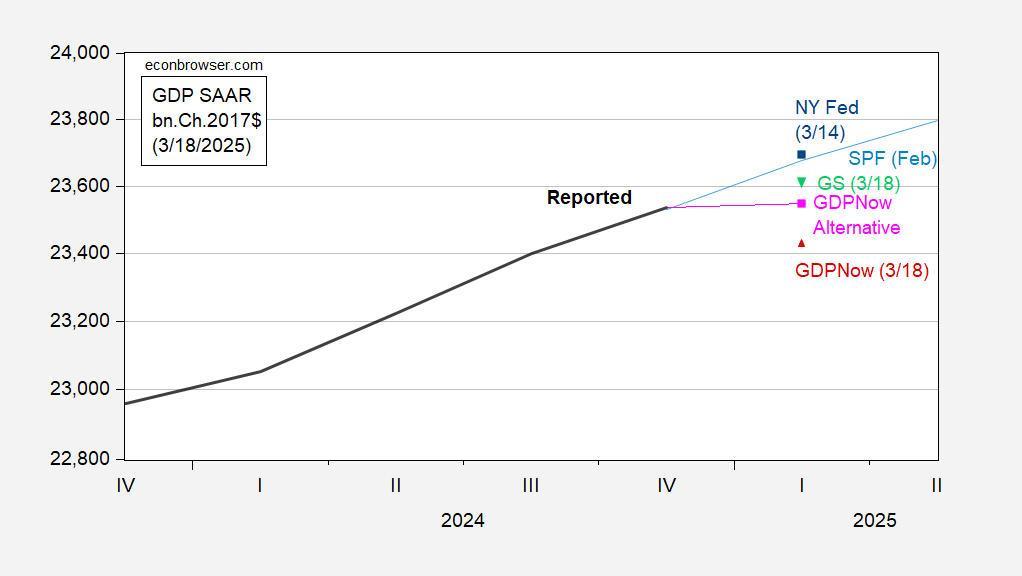

Nowcasts (GDPNow as reported and accounting for gold imports; NY Fed) and tracking (Goldman Sachs) as of today.

Figure 3: GDP (black), GDPNow (red triangle), GDPNow adjusted for gold imports, using Atlanta Fed adjustment for March 7 applied to March 17 (pink square), NY Fed (blue square), Goldman Sachs (inverted green triangle), Survey of Professional Forecasters (light blue), all in billion Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Philadelphia Fed, NY Fed, Goldman Sachs and authors calculations.

Q1 GDPNow, accounting for gold imports, remains essentially flat…