…Where I think I have Value Above Replacement in what I have to say, I will say it. Where I think I do not, I will shut up—and, hopefully, point you to somebody who does…

What can you expect to get from reading this SubStack?

I PROMISE: Economic & Economic Insights, informed by what I see as my extensive experience & expertise. Analytical Lenses, that filter world events past and present through frameworks that strip away confusion and leave key insights behind. Historical Context, for history rhymes. Plus Thoughtful Recommendations, and reviews and critiques that open the intellectual oysters that others have written.

I HOPE FOR: Public Sphere Enhancement, keeping you away from the dopamine-loop clickbait biases that affect other media platforms. The Digital Commons, that we all hope to grow. And Intellectual Stimulation & Entertainment, as well.

What is most worth reading?

SubStack readers say:

<div class="digest-post-embed" data-attrs="{"nodeId":"d247666a-416f-49d9-b40c-ef23a981092a","caption":"For Project Syndicate : the unaccountability machines we have built, or how our complex societal systems are making us rich but unhappy as they have become uncontrollable leviathans—massive social and technological mechanisms that are failing us.","size":"sm","isEditorNode":true,"title":"PROJECT SYNDICATE: How Humanity Lost Control: A REVIEW of Dan Davies: \"The Unaccountability Machine: Why Big Systems Make Terrible Decisions – And How the World Lost Its Mind\"","publishedBylines":[{"id":16879,"name":"Brad DeLong","bio":"Author of Slouching Towards Utopia: An Economic History of the 20th Century, sometime Deputy Assistant Secretary of the U.S. Treasury, too online since 1995, UC Berkeley economic historian","photo_url":"https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/ea5ae644-9822-4ca5-ac6b-e18c017d8fbc_1189x1208.png","is_guest":false,"bestseller_tier":1000}],"post_date":"2024-07-02T13:11:51.156Z","cover_image":"https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F986fa075-b959-4a88-881b-4850538d74db_1324x658.png","cover_image_alt":null,"canonical_url":"https://braddelong.substack.com/p/project-syndicate-how-humanity-lost","section_name":"Enlarging the Bounds of Human Empire","id":146044550,"type":"newsletter","reaction_count":13,"comment_count":2,"publication_name":"Brad DeLong’s Grasping Reality","publication_logo_url":"https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ffde2453e-9c18-4560-82ca-8b77ae62ef5b_1280x1280.png","belowTheFold":true}”>

Google & Google Scholar Say:

-

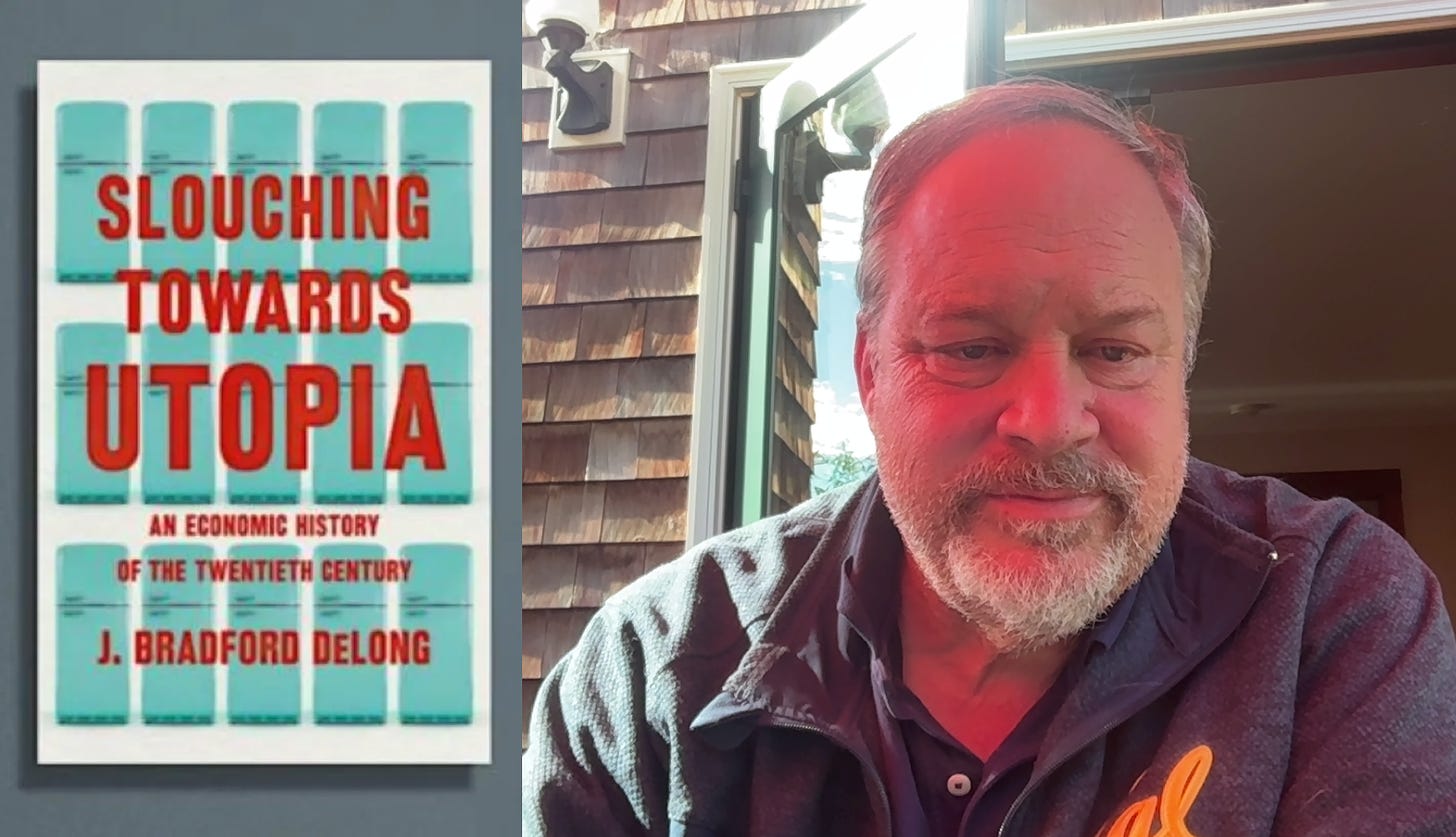

Slouching Towards Utopia: An Economic History of the 20th Century—The book tells the story of how an unprecedented explosion of material wealth occurred, how it transformed the globe, and why it failed to deliver us to utopia. Of remarkable breadth and ambition, it reveals the last century to have been less a march of progress than a slouch in the right direction. DeLong, J. Bradford. 2022. Slouching Towards Utopia: An Economic History of the 20th Century. New York: Basic Books <http://bit.ly/3pP3Krk>

-

“Noise Trader Risk in Financial Markets” (with Andrei Shleifer and Lawrence Summers of Harvard, and Robert Waldmann of the University of Rome)—how Milton Friedman’s claim that irrational investors must in equilibrium have no impact on market prices is simply, well, wrong. DeLong, J. Bradford, Andrei Shleifer, Lawrence H. Summers, & Robert J. Waldmann. 1990. “Noise Trader Risk in Financial Markets.” Journal of Political Economy 98 (4).<http://ms.mcmaster.ca/~grasselli/DeLongShleiferSummersWaldmann90.pdf>

-

“Fiscal Policy in a Depressed Economy” (with Lawrence Summers of Harvard)—how when inflation is as quiescent & interest rates as low as they have been since 2001, bond- & money-financed expansions of government purchases are, when properly hedged, truly a win-win free lunch that competent governments would pursue. DeLong, J. Bradford, & Lawrence H. Summers. 2012. “Fiscal Policy in a Depressed Economy.” Brookings Papers on Economic Activity (Spring): 233-297.<https://www.brookings.edu/about/projects/bpea/papers/2012/fiscal-policy-depressed-economy-delong>

-

“Did J.P. Morgan’s Men Add Value?”—reputation, managerial competence, oversight, & the benefits to society of long-term greedy plutocratic investment banks. DeLong, J. Bradford. 1990. “Did J.P. Morgan’s Men Add Value? A Historical Perspective on Financial Capitalism.” In Inside the Business Enterprise: Historical Perspectives on the Use of Information, edited by Peter Temin, 205-249. Chicago: The University of Chicago Press.<https://www.nber.org/chapters/c7182.pdf>

-

“Speculative Microeconomics for Tomorrow’s Economy” (with A. Michael Froomkin of the University of Miami)—how the “Smithian” image of the economy that we economists have held in the forefront of our minds since 1776 is obsolete. DeLong, J. Bradford, & A. Michael Froomkin. 2000. “Speculative Microeconomics for Tomorrow’s Economy.” In Internet Publishing and Beyond: The Economics of Digital Information and Intellectual Property. Cambridge, MA: MIT Press. <http://osaka.law.miami.edu/~froomkin/articles/spec.htm>

-

“The Marshall Plan: History’s Most Successful Structural Adjustment Program”: In this paper, DeLong explores the success of the Marshall Plan post World War II, analyzing its impact on European economic recovery and its role as a model for future economic assistance programs. DeLong, J. Bradford, & Barry Eichengreen. 1993. “The Marshall Plan: History’s Most Successful Structural Adjustment Program.” In Post-World War II Economic Reconstruction and its Lessons for Eastern Europe Today, edited by Rudiger Dornbusch et al., Cambridge: MIT Press. <https://www.nber.org/papers/w3899>

-

“Globalization and Convergence”: This paper discusses the phenomenon of globalization, focusing on the convergence of income levels across countries and the implications of this process for global economic policy. Dowrick, Steve, & J. Bradford DeLong. 2003. “4 Globalization and Convergence.” In Globalization in Historical Perspective, edited by Michael D. Bordo, Alan M. Taylor, and Jeffrey G. Williamson, 191-226. Chicago: University of Chicago Press. <https://www.degruyter.com/document/doi/10.7208/9780226065991-006/html>

-

“The End of Influence: What Happens When Other Countries Have the Money” (with Stephen S. Cohen): This book, co-authored with Stephen S. Cohen, delves into the shifting global economic landscape, focusing on how the rise of other economies affects the United States’ economic and political influence. Cohen, Stephen S., & J. Bradford DeLong. 2010. The End of Influence: What Happens When Other Countries Have the Money. Basic Books.

-

“Positive Feedback Investment Strategies and Destabilizing Rational Speculation”: Exploring the dynamics of stock market bubbles and crashes. How positive feedback investment strategies, where investors buy or sell stocks in response to recent price movements, can lead to excessive stock price volatility. Such strategies can create self-reinforcing trends, leading to significant deviations from fundamental values. DeLong, J. Bradford, Andrei Shleifer, Lawrence H. Summers, & Robert J. Waldmann. 1990. “Positive Feedback Investment Strategies and Destabilizing Rational Speculation.” Journal of Finance 45 (2): 374-97. <https://www.nber.org/papers/w2880>

-

“This Time, It Is Not Different: The Persistent Concerns of Financial Macroeconomics”: The financial and macroeconomic policy challenges following the financial crisis of 2007-2008, offering insights into policy responses and long-term economic implications. DeLong, J. Bradford. DeLong, J. Bradford. 2012. “This Time, It Is Not Different: The Persistent Concerns of Financial Macroeconomics.” In Rethinking the Financial Crisis, edited by Alan S. Blinder, Andrew W. Lo, and Robert M. Solow, 59-95. New York, NY: Russell Sage Foundation.