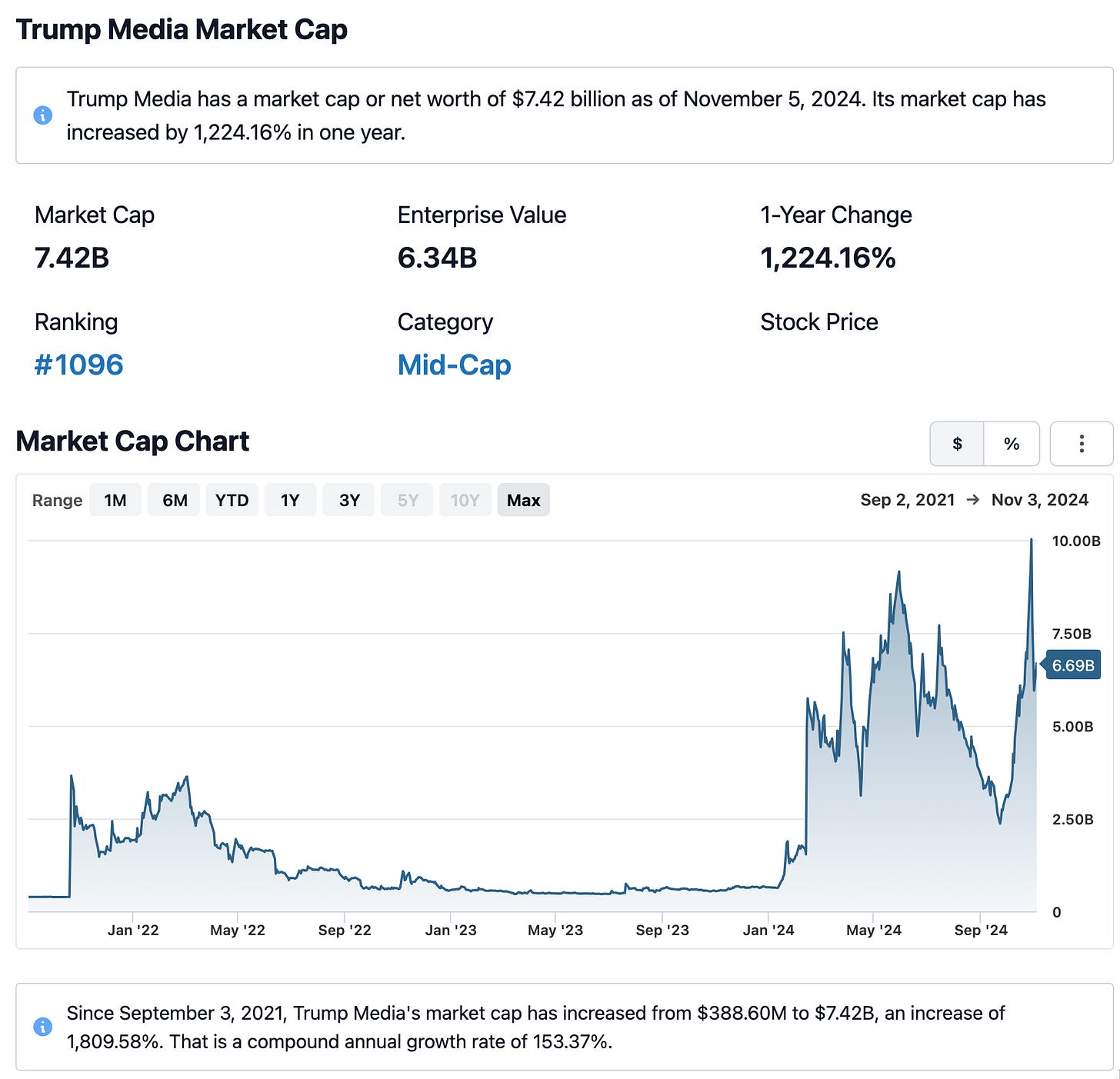

Investors gamble on DJT shares as potential political leverage. The marginal Wall Street investor holding the stock of DJT right now implicitly believes that the expected present value of future opportunities of using this vehicle to bribe Donald Trump by buying his shares is his 57% share x its $7.4 billion current valuation = $4.2 billion.

Given how corrupt he is and given that he has a 50% shot of becoming president-elect today, that seems rather low. But maybe people are thinking that he will want to be bribed via vehicles other than DJT stock purchases where he can collect 100% of the proceeds, rather than have others selling their DJT stock to bribers alongside him take their cut? Maybe this is just the 10% we see of the value of the future kleptocratic iceberg?…

Does anyone see DJT as a media company? Or even as a GameStop- or AMC-like meme stock?

I really do not think so.

I think the bet is that the people who own DJT today are people who think that in a future in which Trump is president again, being recorded in the stock book as owning DJT will be a good way of demonstrating that you are willing to bribe Donald Trump in order to get supportive action from the government—plus a defense against attracting his ire: “They like us! They bought DJT even before the election!”:

This is, I think, in striking contrast with the people who bought and owned DJT in late 2021 and in 2022, who were betting either that it would be a successful and profitable media business or simply pledging meme-stock allegiance to Donald Trump.

At its peak in late October, DJT was worth more than Twitter. This was the case even though it has only about $4 million a year in revenue—less than the revenue of a medium-sized McDonald’s:

Matt Levine: DJT: ‘New York magazine… a very fun profile…. Its fairly hapless founding by former Apprentice contestants, its struggles to go public by merging with a special purpose acquisition company, etc.: “The upshot was that even with the SPAC maneuver and its $300 million in limbo, there would be enough capital to build a social network. And the executives had decided on a name. At a meeting at Trump’s golf club in Bedminster, New Jersey, Moss and Litinsky pitched him on Virt, short for virtuous. Trump suggested Truth instead. They looked up the domain TruthSocial.com, saw that it was available for a little more than $2,000, and bought it. When they ran the name by Melania, she burst out laughing. ‘Truth?!’ she said, pointing at her husband. ‘This guy?’… <https://www.bloomberg.com/opinion/articles/2024-08-05/the-good-trades-have-gone-bad>

DJT’s unicorn-scale valuation back in early 2022 was one of the things that led to Matt Levine’s Dark Night of the Soul:

Matt Levine: Donald Trump Does a SPAC Deal: ‘If we are still here in a month I will absolutely freak out. Stock prices can get totally disconnected from fundamental value for a while, it’s fine, we all have a good laugh. But if they stay that way forever, if everyone decides that cash flows are irrelevant and that the important factor in any stock is how much fun it is to trade, then … what are we all doing here?… Doesn’t it feel like there has been a paradigm shift, a regime change? Doesn’t it feel like for the last 80 or so years there has been a dominant view of investing, a first-page-of-the-textbook given, that investments are worth the present value of their expected future cash flows? Doesn’t it feel like that world has ended and a new one has begun? I should go buy some Dogecoin… <https://www.bloomberg.com/opinion/articles/2021-10-21/matt-levine-s-money-stuff-donald-trump-does-a-spac>

But while GameStop and AMC were valid reasons for Matt to freak out, I do not think that DJT ever was such. At its core was, instead, not just people who wanted and people who were betting that other would want to pledge meme-stock allegiance to Trump, but also people wanting to speculate that it would become a principal bribe vehicle for getting money to Trump in exchange for favors.

Certainly it is not a media business.