Retirement and Financial Challenges

Despite soaring costs in Canada, particularly in real estate, the incomes of Canadians have not kept pace with the increased cost of living. Both average and median incomes have grown at a slower rate than the consumer price index (CPI). From 1980 to 2022, the average and median salaries increased by only 50% and 25% respectively, resulting in minimal year-over-year growth. In stark contrast, the CPI has surged nearly 400% between 1980 and 2023, indicating that salaries have not kept up with the cost of goods and services.

This disparity is especially pronounced in the real estate market. For example, the average price of a property in Toronto has skyrocketed from $75,694 in 1980 to $1,126,591 in 2023. Similar trends are observed in other major cities like Vancouver.

At the same time, life expectancy in Canada has increased from ~75 years in 1980 to ~83 years in 2023. Remarkably, 5 out of 10 Canadians aged 20 today are expected to reach age 90, and 1 out of 10 may live to 100. However, this increased longevity, while a positive development, raises concerns about the affordability of retirement.

In an environment where people live longer but face stagnant income growth, soaring living costs, and high interest rates, Canadians are increasingly questioning their financial future and their ability to afford a decent retirement.

How Much Money Do You Need to Retire?

Determining the amount of money you need to retire is complex and depends on several factors. Here are some key considerations:

- Lifestyle Expectations: What kind of lifestyle do you envision for your retirement? What lifestyle are you accustomed to now?

- Mortgage Status: Do you have a mortgage that will still need to be paid off during retirement?

- Life Expectancy: How long do you expect to live?

- Health Condition: What is your current health status, and do you anticipate any significant healthcare expenses?

- Additional Income Sources: Do you have other sources of income or investments?

We explored these factors in detail in one of our recent articles.

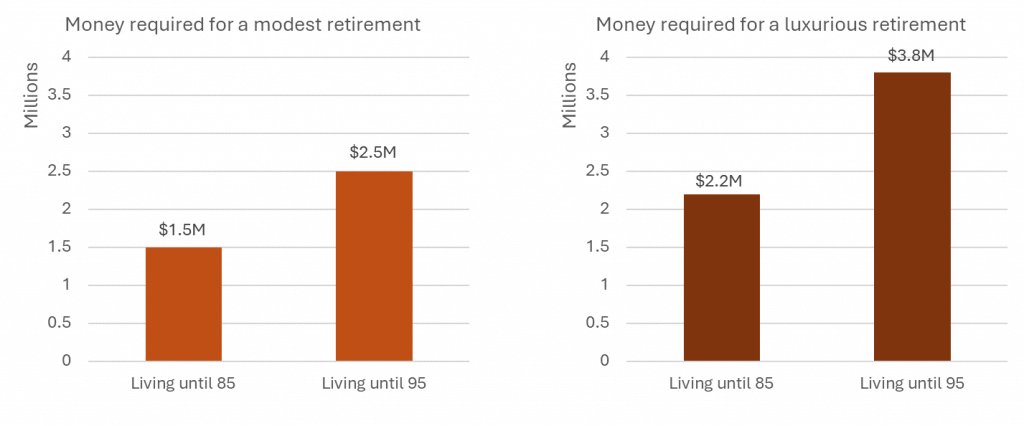

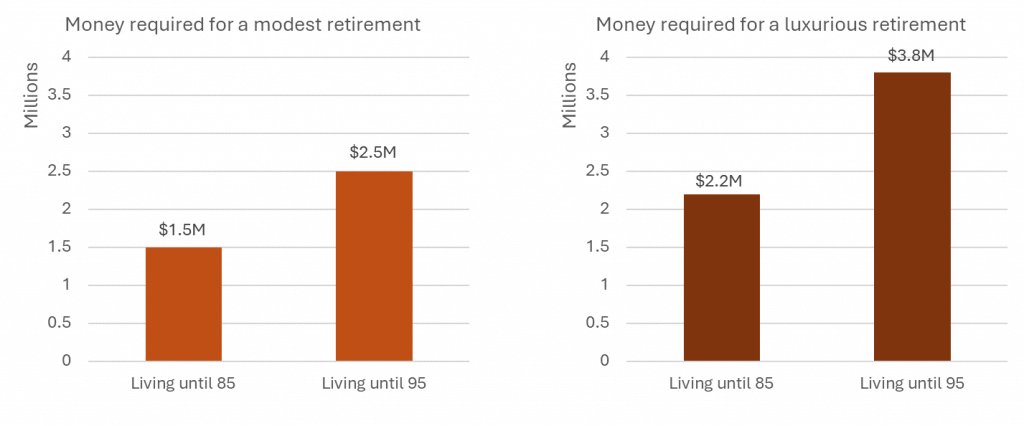

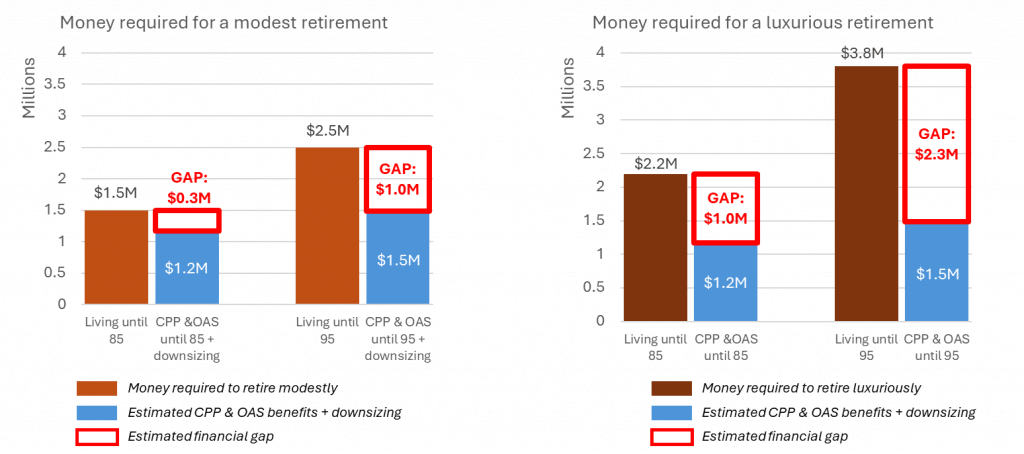

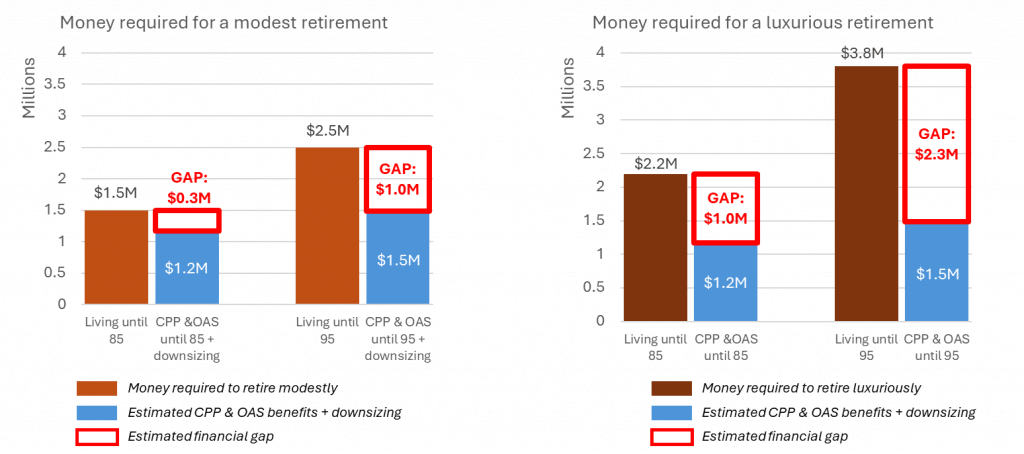

For a simple scenario, consider a modest retirement for a relatively healthy, single person who has paid off their mortgage. This individual should plan for approximately $1.5 million if they expect to live until age 85 and around $2.5 million if they expect to live until age 95.

For those planning a more luxurious lifestyle, the numbers increase. Such a lifestyle would suggest planning for $2.2 million by age 85 and $3.8 million by age 95.

Ultimately, your retirement savings goal will vary based on your unique circumstances and the lifestyle you wish to maintain.

Understanding the Size of CPP and OAS Benefits

The Canada Pension Plan (CPP) and Old Age Security (OAS) benefits are crucial components of the Canadian retirement system. These are defined benefit plans that provide a stable income stream to retirees who have contributed to the programs throughout their working lives.

We have conducted a detailed analysis, adjusting for inflation, to provide you with some approximate figures:

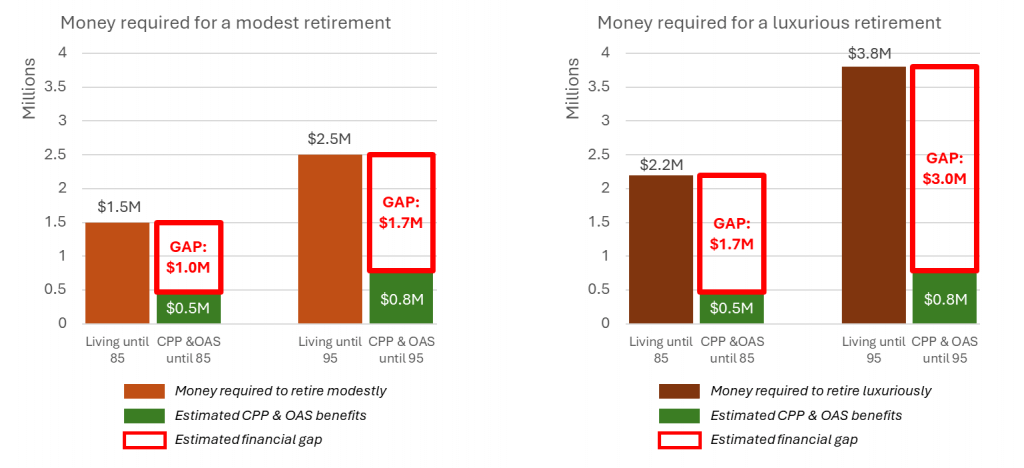

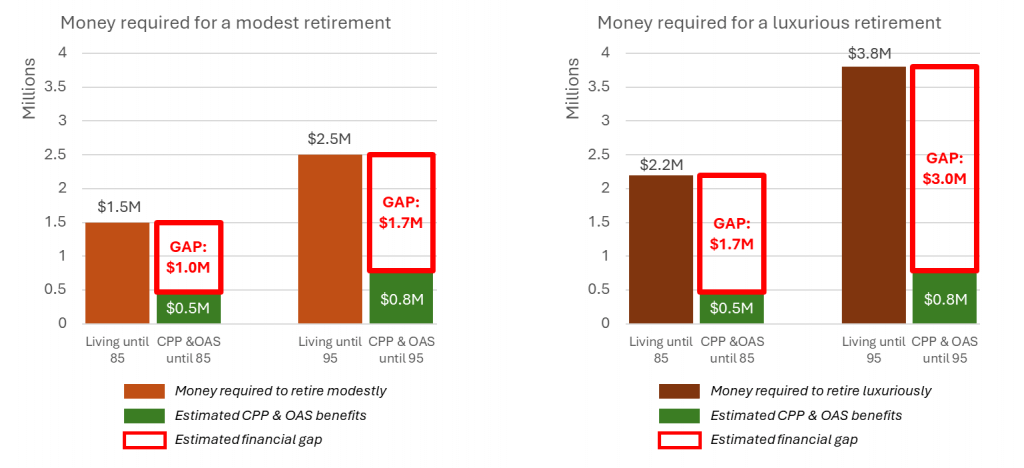

- CPP and OAS collected until the age of 85: ~$500,000

- CPP and OAS collected until the age of 95: ~$800,000

At first glance, it is evident that these amounts alone may not cover all retirement costs.

The question then becomes, how significant is the gap? Given the rising costs of living, especially in areas like housing and healthcare, the gap between the benefits provided by CPP and OAS and the actual cost of a comfortable retirement can be substantial.

Many Canadians will find that they need additional savings, investments, or income sources to bridge this gap and ensure financial stability throughout their retirement years.

How Big Is the Retirement Gap?

When evaluating the size of CPP and OAS benefits, it’s essential to consider how these amounts stack up against the total cost of retirement. Based on our previous analysis, the approximate gap for a modest retirement is significant: $1M if you live until age 85 and $1.7 million if you live until age 95. For those seeking a more luxurious retirement, the gap becomes even more pronounced, rising to $1.7 million at age 85 and $3 million by age 95. These figures highlight the substantial difference between what CPP and OAS provide and the actual costs required to maintain a comfortable standard of living.

Bridging this gap often requires additional savings, investments, and careful financial planning to ensure a secure and fulfilling retirement.

Is the Gap Bridgeable and How?

The good news is that most of the retirement gap can be bridged with proper preparation. Here are a few strategies to consider:

Real Estate

Historically, real estate has been a strong source of financial security and growth. For example, if you purchased an average-priced home in 2000 for $250,000, it would be worth approximately $1,125,000 today.

If you were to downsize from a $1.5 million house to an $800,000 condo or move to a more affordable area, your financial retirement gap could be reduced to $200,000 for a life expectancy of 85 years and $1 million for a life expectancy of 95 years.

For those seeking a more luxurious lifestyle, these numbers would be $1 million and $2.3 million for life expectancies of 85 and 95 years, respectively.

Additional Investments/Savings

Many Canadians have various types of investments and savings, including but not limited to RRSPs, TFSAs, GICs, and stocks. These investments can provide an additional source of funds for retirement. However, it’s important to note that some investments carry higher risks than others (e.g., high-risk investment portfolios). Incorporating risk considerations into your retirement financial strategy is crucial to ensure a stable and secure retirement.

Continue Working

Not everyone plans to retire fully. Some individuals may enjoy their work and choose to extend their professional life. Others might own businesses and manage them during retirement, either personally or with the help of additional resources. Additionally, hobbies such as gardening, baking, painting, photography, or writing can sometimes be turned into profitable ventures, providing a sustainable source of income.

Rental Income

With high rent levels in Canadian cities like Toronto, Montreal, and Vancouver, owning one or more rental properties—especially those that are largely paid off—can generate additional income. This rental income, combined with real estate appreciation, can help address retirement financial needs. Rental properties can also be sold relatively easily, potentially resulting in a significant lump sum that can be used for retirement expenses.

Living with a Spouse/Partner

When living with a spouse or partner, you effectively pool resources from both household members while needing only one property to live in. This shared approach can reduce the overall financial burden and help bridge the retirement gap more efficiently.

Reverse Mortgage

A reverse mortgage is a financial arrangement that allows homeowners aged 55 and older to access the equity in their home while continuing to live there. Unlike traditional mortgages, where the borrower makes payments to the lender, in a reverse mortgage, the lender makes payments to the homeowner based on the home’s equity. The loan does not need to be repaid until the homeowner sells the property, moves out, or passes away.

This type of mortgage can provide retirees with a steady stream of income or a lump sum to cover living expenses, healthcare costs, or other financial needs. The amount available to borrow depends on factors such as the home’s value, the homeowner’s age, and interest rates.

While the reverse mortgage can help improve financial liquidity, especially for retirees, it is important to understand that it reduces the home’s equity and may impact inheritance.

Income-Generating Insurance

Certain types of life insurance combine both insurance and wealth accumulation components.

Whole life insurance is a versatile financial tool that not only provides lifelong coverage but also features a cash value component that can grow over time. Unlike term life insurance, which offers protection for a specific period without accumulating value, whole life insurance builds cash value through regular premium payments. This cash value grows at a guaranteed rate and can be bolstered by dividends from the insurance company. As the policy matures, the accumulated cash value can be accessed for various financial needs, such as loans or withdrawals.

Additionally, the cash value can be invested in different ways, allowing policyholders to potentially grow their wealth. This dual benefit of insurance protection and wealth accumulation makes whole life insurance a valuable component of a comprehensive financial strategy. Over the long term, the policy not only provides financial security but also serves as a growing asset that can enhance overall financial stability.

Infinite Banking

Infinite banking is a personal finance approach that utilizes a whole life insurance policy as a “personal bank.” This approach involves taking loans against the policy and increasing cash flow through the policy’s dividends. At the heart of infinite banking is a participating whole life insurance policy. With such a policy, you can borrow money using the policy’s cash value as collateral, eliminating the need to pay interest to external lenders. This setup creates a personal banking system, providing quick access to additional funds through the insurance company.

This approach offers flexibility and access to accumulated funds, though it comes with its own set of constraints. We have a separate article that delve deeper into the details of the infinite banking strategy.

Final Words

As demonstrated, the funds required for a worry-free retirement are higher than ever, often reaching into the millions. Government programs like CPP and OAS are not sufficient to close this gap on their own, but numerous strategies can help bridge it. Exploring these options and incorporating them into your retirement planning can significantly improve your financial outlook.

If you’re interested in discovering how some insurance products can enhance your retirement planning, complete a quote on the sidebar or visit this link.